In the Land of Plenty, Why Bother?

African economies have been growing rapidly and growth rates far in excess of what can be expected in Europe or North America are expected in the future. For example:

- McKinsey Global Institute’s Report of June 2010 “Lions on the Move: The Progress and Potential of African Economies” predicts massive growth in GDP and Consumer Spending (GDP forecast to rise from $1.6trillion in 2008 to $2.6trillion by 2020 with a rise in consumer spending over the same period from $860billion to $1.4trillion)

- The World Bank in its report Global Economic Prospects for 2011 projected that the region will have the third highest growth in the world behind South Asia and East Asia

In such an optimistic environment, a good question for investors is “why bother building long-term relationships with clients when markets are so abundant?” After all, it would be convenient to argue, in a vibrantly growing economy there is always going to be another client to work with and sell to – what does it matter if you lose an existing client in such a plentiful marketplace? This is a tempting view (building relationships can be difficult and time consuming) but it is profoundly misguided.

In our experience, building long-term relationships with your customers and clients is not only desirable but essential for success in an increasingly competitive world. Africa (and, indeed, emerging markets in general) are no different. There are certain fundamental market conditions that drive businesses to need to build long-term relationships, and these occur in any situation where:

- Repeat business is a strong possibility;

- The costs of acquiring a new customer are significantly greater than repeat sales to an existing customer;

- Reputational costs are high – i.e. the opinion of one customer can profoundly affect the opinion and behaviour of other and future customers;

- There are significant emotional components to an effective sale – i.e. successful sales are not driven solely by price or the specific feature of the product or service but, rather, by an ‘emotional bond’ between you and your client and a strong desire by your client to buy your product or service from a specific person in your company.

These factors certainly hold true in our core area of experience, professional services, and also in other sectors such as financial services (particularly banking), telecoms, IT services and the hospitality industry, to mention but a few. Thus there are compelling reasons to invest in building long-term relationship with customers and clients, irrespective of immediate sales opportunities. This is as true in Africa as it is in mature, Western markets.

In addition, there is the simple fact that, in a vibrant and rapidly growing economy, you are effectively placing a series of bets based on staying power and success. Who amongst your customers is going to be a future success and a major player? Economies in ferment can produce strange results and it is difficult to predict which businesses will win through in the long run.

So, not only do market fundamentals drive the desirability of building relationships but the need to minimise the risk of alienating a potential future market leader means it is doubly in your interest to do so.

What Does It Take To Build Trust?

The key to successful long-term business relationships is trust between the individuals concerned. How is trust built in African economies and is it any different from building trust in more developed economies?

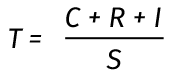

In service industries the best accepted model that describes the components of trust was developed by David Maister and outlined in his book The Trusted Advisor, Maister, Green & Galford (2002) – see below.

T = Trust C = Credibility R = Reliability I = Intimacy S = Self orientation

Our work across sub-Saharan Africa shows that the Maister equation is fundamentally accurate and holds true across multiple countries, cultures and economic conditions. Indeed, it would seem as if the fundamental components of trust are “hard wired” so to speak within human brains. Wherever we have been, the same key concepts and needs are expressed by the people we speak to when we ask them what they seek and need if they are to trust someone. This is hardly surprising, neurology (and the role of the amygdala and limbic system in general in controlling emotion) does not change from race to race or continent to continent and issues of trust, risk and fear arose very early in the development of homo sapiens.Maister argues that the level of trust a client will have in you is not only dependent on the credibility and reliability of the service you provide (typically understood factors of trust), but is also dependent on what is called ‘business intimacy’ (emotional closeness concerning the issues at hand) and a low self-orientation (being in it more for the good of client than just for the money).

However, although the components of trust seem hard wired into the human brain, the behaviours needed to gain trust are not necessarily displayed by individuals. The imperative to win business, personal guardedness in new business relationships and the challenges of doing business in a new culture compound the stress felt by individuals and get in the way of them behaving in ways that would be most successful. These behaviours can, however, be successfully learned and we have found that perfecting them has been eagerly embraced by our African clients.

But we have also discovered that African markets have their own peculiar challenges which need to be taken into account when building trust. The following are some of the conclusions we have arrived at which have proved to be helpful reference points when thinking about trust in an African context:

- Ethnic group / tribal allegiance – However much it may be unacknowledged or regarded as no longer acceptable, ethnic group or tribe can still be a significant help or hindrance in building trust. There are some inter-group issues which may prevent trust from ever being built or mean that trust is more easily or rapidly established.

- Age – The role of elders and the respect shown to them in African society carries across and can have an impact in a business environment. This means that, with some individuals, deep trust can only be built between individuals of roughly comparable age.

- Gender – in societies where gender roles are still relatively deeply embedded, there are situations where trust cannot be built successfully between men and women in a business environment.

- Religious affiliation –there are some regions where religious conflict prevents trust being built between individuals of different religious beliefs.

- Cultural notions of what ‘trust’ entails – our experience shows us that Africa is most certainly not ‘one continent’. Neighbouring countries can have completely different cultures, social mores and qualities of relationship, all of which have implications for the way in which trust is built between people.

- Race – Africa is not just one race either and racial issues do need to be considered. Certainly as Europeans consulting in an African environment we are aware that race can be as ‘unspoken’ an issue in our discussions as when we are dealing with interracial groups elsewhere.

To give but one example, we have worked with a professional services firm where a Board Level client (male) absolutely refused to work with anyone other than the Partner with overall responsibility for the client despite the fact that a younger and more junior female member of staff had more up to date knowledge of the project and had been given full responsibility for day to day contact. On closer examination we discovered that not only did age and gender play a part but that both the Board Level client and Partner were members of the same tribe and spoke the same dialect! This was, ruefully, acknowledged as being an insurmountable issue.

None of the above, by the way, is totally unique to Africa. As consultants we have come across instances of many of these factors at play within countries and regions of Europe (e.g. the tensions between Flems and Walloons in Belgium or, even more pronounced, between Serbs and Bosnians in the former Yugoslavia). All of the above need to be considered on a case-by-case and country-by-country basis when considering how best to build trust and achieve successful long-term business relationships in Africa and take advantage of the burgeoning opportunities there.

What Is Different In Africa?

Although the fundamental need for long-term trusting relationships is the same in African as in Western economies, and the fundamental components needed to achieve them remains the same, this doesn’t mean to say that Africa (and, we suspect, emerging markets in general) don’t pose their own peculiar needs and pressures. Perhaps the greatest of these is the issue of infrastructure and access. For example, although it is agreed that the best way to form a trusting relationship is face-to-face contact:

- What do you do if your client is on the other side of the country or continent and you can’t rely on air or rail travel to get you there for an appointment or, indeed, get you back on time for your next meeting at your home base?

- In a city such as Lagos with its perennial traffic problems it simply may not be feasible to arrange and travel to frequent face-to-face meetings (the writers of this article took over 3 hours to make the relatively simple trip from the airport to the centre of Lagos and were assured that this was a very good time indeed).

- The costs of flying across African countries are significantly more expensive than flying to centres such as, say, Nairobi and Johannesburg, and often requires flying to these centres to cross a few African countries.

In these circumstances other factors become significantly more important to your client as ‘surrogate indicators’ of your good intent and ability to be trusted. In our work with professional services firms across Africa some things are consistently reported as critical in ensuring that they can build long-term relationships with their clients. These are:

- Accessibility/Responsiveness – you need to be available by email or phone 24/7 and, similarly you have to be able to respond to the client’s needs reliably and rapidly.

- Anticipation – you have to be able to anticipate client’s needs and fulfil them. This involves greater than average listening skills – and using all your senses – in order to be able to read between the lines of your client’s communication and anticipate their needs in a way that they may not yet be articulating. Fortunately, this is a skill that can be trained.

- Abundance/Generosity – giving of professional support and investing in your client without expecting immediate payment or returns. This includes giving information freely, providing access to your networks and dedicating your time in a way that demonstrates an abundant mindset.

- Approximating face-to-face interaction – Skype and other video conferencing technologies can, in part, replace face-to-face contact. Even in their absence, the most effective client-facing staff are able to adopt a telephone manner that is less formal and stilted and more like a face-to-face conversation.

In as exciting a world as the African marketplace we, for one, are observing with fascination how the field of relationships between providers and their clients plays out. It will be interesting to see whether the commercial opportunities in the new frontier are accompanied by a similarly savvy and evolved way of doing business and building business relationships.

| Case StudyOver the past two and a half years we have been working with one of the global professional services firms interested in developing its business practices across all of the African regions. Our work with them has used a variety of models, techniques and methodologies all aimed at furthering their ability to form, deep, close, long-term, trusting and, ultimately, profitable relationships with their clients in Africa.The basic approaches had originally been developed for their European businesses but consulting with, and delivering, these methods to their senior client-facing staff across eight countries in Central Africa and South Africa confirmed that the philosophy and methods work within an African context too.The new approach has been enthusiastically taken up by staff as a better way to do business and now serves as the central approach aimed at differentiating them in their market as professional service providers. Results to date already show a remarkable return on investment. When surveyed, 97% of respondents regarded the new approach as improving the way they related to their clients with:

· 78% regarding their relationships as having improved for the better · 35% discovering more opportunities for cross selling · 63% finding it easier to sell themselves in client situations Most importantly respondents reported increased revenues as a result of the new approach to client relationships. If pro-rata’d across all attendees and territories these revenues amount to millions of dollars of new fees. |

Adam Gold and Gina Hayden are based in London and run international client relationship skills programmes, specialising in developing companies’ capabilities in connecting with their clients, listening deeply to clients’ needs, asking profound and transformative questions and establishing long-term, high trust relationships.

They can be contacted at: